Ammon News - Reuters

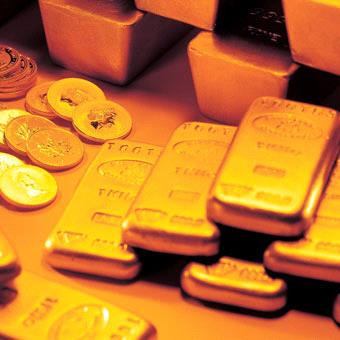

Gold fell for a fourth straight session on Thursday to its lowest level since a 15 percent plunge in mid-April, after the U.S. Federal Reserve signaled it would slow the pace of bond purchases later this year.

A scale-back of the $85 billion monthly asset purchases is likely to weaken support for gold prices, already down about 20 percent this year due to rapid outflows from exchange-traded funds and slowing demand in top consumers, India and China.

Spot gold fell 1.6 percent to $1,328.75 an ounce by 7:09 GMT, down more than 4 percent for the week. It fell to $1,322.79 earlier in the session - not far off the lows in mid-April when gold fell the most in 30 years.

“I wouldn’t be in a rush to say it’s the end of gold,” said Amber MacKinnon, an analyst at Nomura Securities in Sydney. “This is definitely a big turning point. But though we have seen some reasonable amount of stability in the U.S. economy, there is still a long way to run.”

“Early next year will be pretty telling in terms of economic data. We’ll have to see how unemployment reacts to any scale-back in bond purchases.”

Fed Chairman Ben Bernanke said on Wednesday the central bank will continue to reduce the pace of bond purchases in measured steps through the first half of next year, ending purchases around mid-year if the U.S. economy continued to strength.

Until recently, gold, seen as a hedge against inflation, had gained as the global economy took a hit and central banks acted to boost their economies.

Gold touched an all-time high of$1,920.30 in 2011.