Ammon News - AMMONNEWS - In 2004, relatives of some American citizens killed or injured by terrorist attacks in Israel sought redress in an unusual way. They filed a multibillion-dollar lawsuit against Arab Bank, the largest financial institution in Jordan, accusing it of transferring funds to Hamas leaders and other terrorists responsible for the attacks.

A decade later, the case has provoked a significant split in the Obama administration, according to current and former officials, pitting the State Department, which wants the administration to come to the bank’s aid, against the Treasury and Justice Departments, which want the government to stay out of it. The case is scheduled to go to trial in August.

Bank Hit With Sanctions in Suit Over Terrorist AidJULY 13, 2010

But Arab Bank has asked the Supreme Court to intervene now and overturn sanctions imposed by the trial judge when the bank refused to turn over private customer records. The Supreme Court has asked whether the government thinks it should hear the case, and the Obama administration is at an impasse over what to tell the justices.

The quandary facing the administration stems from the unusual trade-offs between issues that are rarely linked, including diplomatic efforts to achieve Middle East peace, the rights of American victims of terrorism, and an American campaign to tear down Swiss banking secrecy laws that have long aided tax evasion.

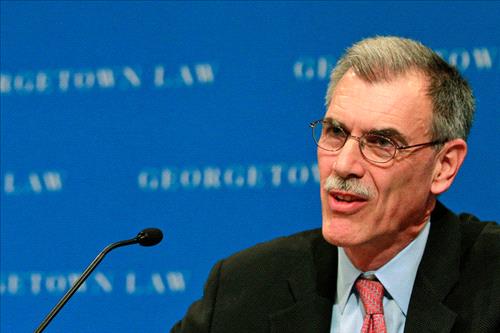

Solicitor General Donald B. Verrilli Jr. is expected to make a decision about what to tell the Supreme Court in the next few weeks. Press officials for Justice, State and Treasury Departments declined to comment, and both current and former officials familiar with the deliberations spoke on the condition of anonymity.

The lawsuit was filed in Federal District Court in Brooklyn. Known as Linde v. Arab Bank, in its current form it focuses on the deaths of 39 Americans and the injury of 102 others in two dozen terrorist attacks during the second intifada in the early 2000s. The plaintiffs contend the Jordanian bank transferred money to Hamas leaders and administered a Saudi-funded program that paid a standard benefit of $5,316 to thousands of families of people killed in the conflict with Israel, including several suicide bombers.

The bank, which operates in Lebanon and the Palestinian territories, denies wrongdoing and says it did not knowingly or willfully do business with terrorists when processing electronic fund transfers. But the bank may not be able to make that case because it refused to turn over records — names, account numbers and transactional details — as potential evidence.

While the bank turned over some Saudi transactions, it said it was prevented from turning over other records because of Jordanian, Lebanese and Palestinian Authority banking secrecy laws. In 2010, a District Court judge ruled that as a penalty for that “recalcitrance,” the jury would be instructed that they could infer that Arab Bank knowingly and willfully provided banking services to terrorists.

The judge also restricted the bank’s ability to present information to the jury that could rebut that conclusion, such as bringing up the secrecy laws. Arab Bank called those sanctions “draconian” and appealed.

The Office of the State Department Legal Adviser, the officials said, has strongly urged Mr. Verrilli to back Supreme Court intervention on behalf of Arab Bank. It cited the role Jordan plays as an American ally on matters like the war in Syria, counterterrorism investigations and the Israeli-Palestinian peace process.

The State Department’s arguments appear to closely track those made by the government of Jordan, which hired Neal K. Katyal, a former acting solicitor general in the Obama administration, to file a brief before the Supreme Court. The bank has hired Paul Clement, who served as solicitor general in the George W. Bush administration.

The Jordanian brief said the country is a vital ally of Secretary of State John Kerry’s renewed peace efforts between Israel and Palestinians. And it warned that proceeding to a trial under the sanctions order “could devastate the bank,” and destabilize the economies of Jordan, the Palestinian territories, and the surrounding region.

On the other side are some lawyers with the Justice Department’s National Security Division and with the appellate section of its Civil Division who are reluctant to have the government intervene against American victims of terrorist attacks, officials said.

The Justice Department’s Tax Division and the Treasury Department have raised a different concern: The Internal Revenue Service is cracking down on tax evasion, and if the Justice Department says foreign bank secrecy laws should take precedence, it could complicate their efforts to overcome such laws in Switzerland and elsewhere, officials said.

Swiss banking secrecy laws were an impenetrable barrier for generations. But in 2009, amid the financial crisis, the Swiss government and UBS agreed to turn over information about accounts belonging to Americans, and UBS paid a $780 million fine.

The United States has built on that precedent to seek access throughout the Swiss banking system, and may expand that effort to Luxembourg, Israel and Hong Kong, said William Sharp of Sharp Partners, an international law firm that focuses on taxation issues.

“To say that this Lebanese and Jordanian information is protected by secrecy laws would seem to be contrary to what is going on within the Department of Justice and the I.R.S.,” he said. “I understand why D.O.J. and the I.R.S. would not be happy with this.”

Proponents of helping Arab Bank have argued that Mr. Verrilli could say that respect for foreign bank secrecy laws should give way when the government seeks information to enforce laws, but not when people sue for civil damages, officials said. But internal critics of intervening have argued that the bank can make that argument itself.

“It would not be appropriate for the U.S. government to intervene,” said Mark S. Werbner, the lead lawyer for many of the plaintiffs. “We think the court system has addressed the bank’s concerns and followed the law in recognizing the rights of American victims trump foreign countries’ laws that hide bank records.”

But Kevin Walsh, a lawyer for Arab Bank, emphasized that it cooperated with requests for information by the American government in criminal and counterterrorism investigations because banking laws allowed it to do so. He said allowing the case to go forward in its current form would amount to a “trial” that would unfairly damage the bank.

“All we want is a fair trial,” he said. “We feel there are very compelling defenses, and we’d like to be able to present them.”

*New York Times

comment replay

comment replay